Breaking Down Popular Price Action Strategies (Smart Money Concepts and ICT Trading)

If you have been in a trading space for a while, you have probably noticed that there is always a certain “flavour of the month” type of strategy, in other words, the trading system that gets beaten to death by everyone.

Besides the fact that I get nonstop DMs on Twitter asking about Smart money concepts, you can see these “SMC” traders everywhere.

Instagram, Youtube, Twitter and other social media are full of hindsight tradingview charts showing 1-minute timeframes of trades returning 10-20R (returns on risk).

The purpose of this article is not to pick a fight with anyone; I know there is a huge cult following around ICT (Inner circle trader), but before you are going to send your angry comments to my email or DM me on Twitter, just remember that I don’t care.

I make this article to shed some light on why things really happen and why markets move because I am simply tired of hearing this constant “manipulation by market makers”.

If you like this article, read the rest of the blog or join the Tradingriot Bootcamp for a comprehensive video course, access to private discord and regular updates.

For those who are looking for a new place for trading crypto, make sure to check out Woo. If you register using this link and open your first trade, you will get a Tier 1 fee upgrade for the first 30 days, and we will split commissions 50/50, which means you will get 20% of all your commissions back for a lifetime. On top of that, you will receive a 20% discount for Tradingriot Bootcamp and 100% free access to Tradingriot Blueprint.

You can read the article or watch it in video format below.

Table of Contents

Strategy idea

First and foremost, what are Smart Money Concepts?

SMC trading is sort of a derivate from teachings coming from the Inner Circle Trader (ICT).

I had my stab at Michael Huddlestone in the Supply and Demand article a while ago.

Without going much into the ICTs shady past, let’s just say that his trading is based on smart money constantly manipulating price to run stops of retail traders and engineer liqudity.

ICT then calls these guys “market-makers”, the term I will revisit a little later on.

The main reason these concepts got extremely popular is that they are “cool”.

People around the world coming into the market sitting at home in front of Metatrader 4 losing money see these words such as “smart money” and “manipulation” and suddenly feel like they are no retail traders anymore, and they now fully understand how financial markets work as they can see behind the curtain of the shady practices happening every day.

The truth is that the “ICT concepts” work, but the reason why they work is way more boring.

The very popular thing ICT and SMC traders do is renaming and overcomplicating things to sound more appealing, to make you think you have now this inside information that is hidden from everyone else.

If you are going to take a look at this video by Chris Lori, which is over ten years and Chris Lori is one of the people ICT learned from, you might get the idea where all these things come from.

Over the years, these concepts moved to other markets such as crypto, and once again, they are still heavily built on this idea of manipulation and market makers.

I am going to leave you to be a judge and just ask yourself a question if you think someone is sitting inside the bank and spending the whole day watching a 1-minute chart of USD/CHF or some crypto and the only thing they do is run stops from retail traders.

It doesn’t take a genius to realize how dumb this sounds.

But like I said, these concepts work; markets often trade above/below prior highs/lows and reverse from there; markets return to “order block” and continue towards the desired direction.

Let’s have a look at why this happens.

Realistic expectation

Before we take a look at the strategy itself, you need to understand some fundamental concepts and why most of the people that share the “SMC” trading online don’t make money in real trading.

Also, what is worth mentioning is that this is a strictly “SMC Traders thing” as I was doing some research for this article, I went through little of ICTs content and he never really promotes this type of trading, I also found some of his risk management videos and there is a bit of solid advice presented in them.

So why you cannot make 10R from every trade like everyone else on Instagram?

If you are fairly new to trading, the R stands for 1 unit of your risk.

If you see someone online talking about a 3R trade, it means they made three times their risk; in other words, if they risked $1000, they made $3000.

A very simple concept that I am sure most of you know well, it has been discussed many times online and on this site as well; if you want to little more details, make sure to read the risk management article.

The issue with most SMC traders you see online, they always tend to post trades with just a few ticks of stop-loss and huge rewards.

There are essentially few problems with this.

The easiest explanation of why taking 10R trades is not realistic is if we assume for a while it is.

Trading on a 1-minute chart gives a fair amount of trading opportunities during the day; let’s say you monitor 2-3 markets, and there will be at least two trades per day on most days.

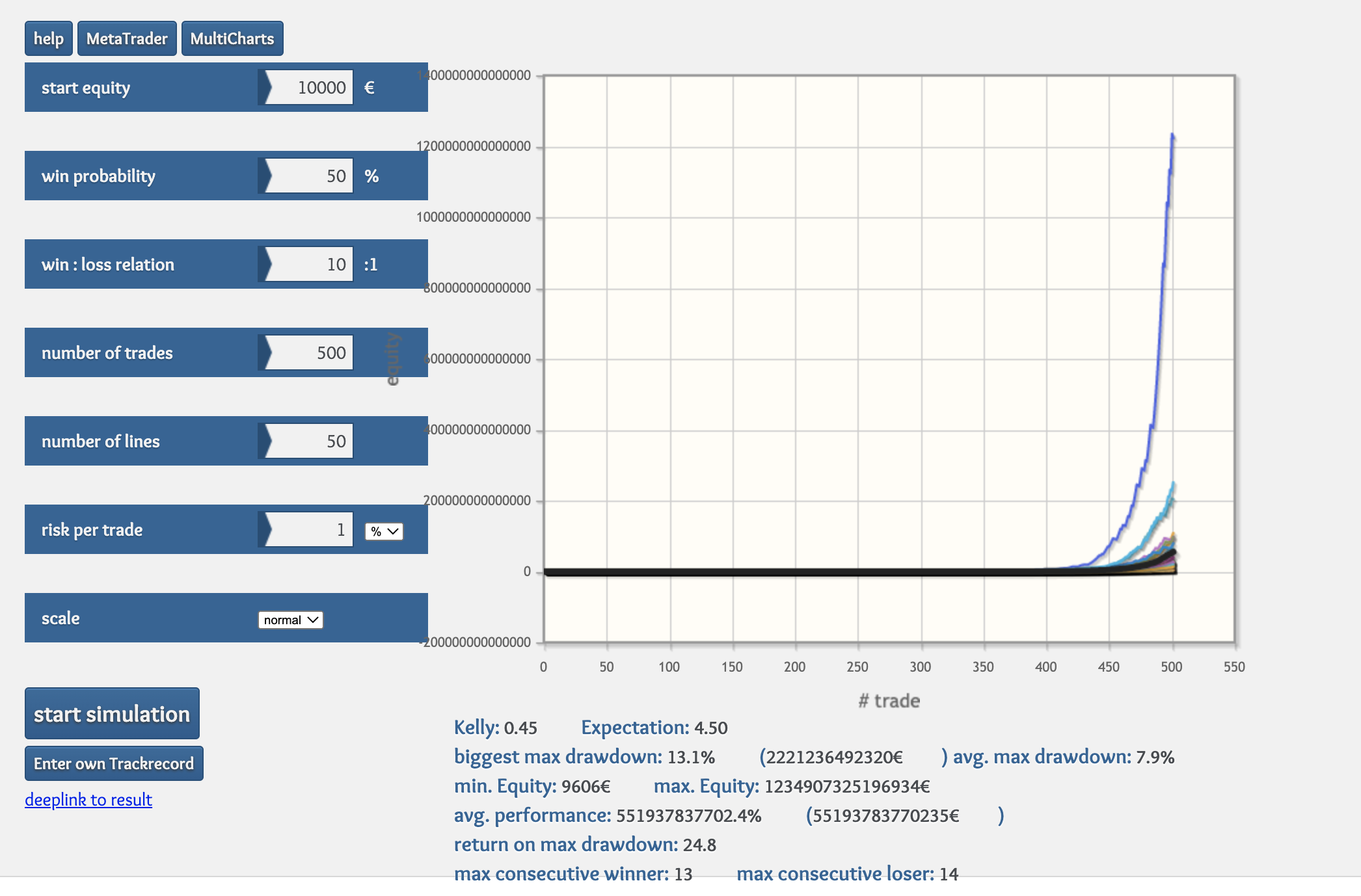

Using this logic, there are approximately 250 trading days in a year so let’s say you will take 500 trades during the whole year.

Each trade has 10:1 Rewards to risk ratio, and you are right in 50% of cases.

Starting with a 10,000 Euro account you would make a 13-figure profit at the end of the year, and you are now the richest man in the world, congratulations.

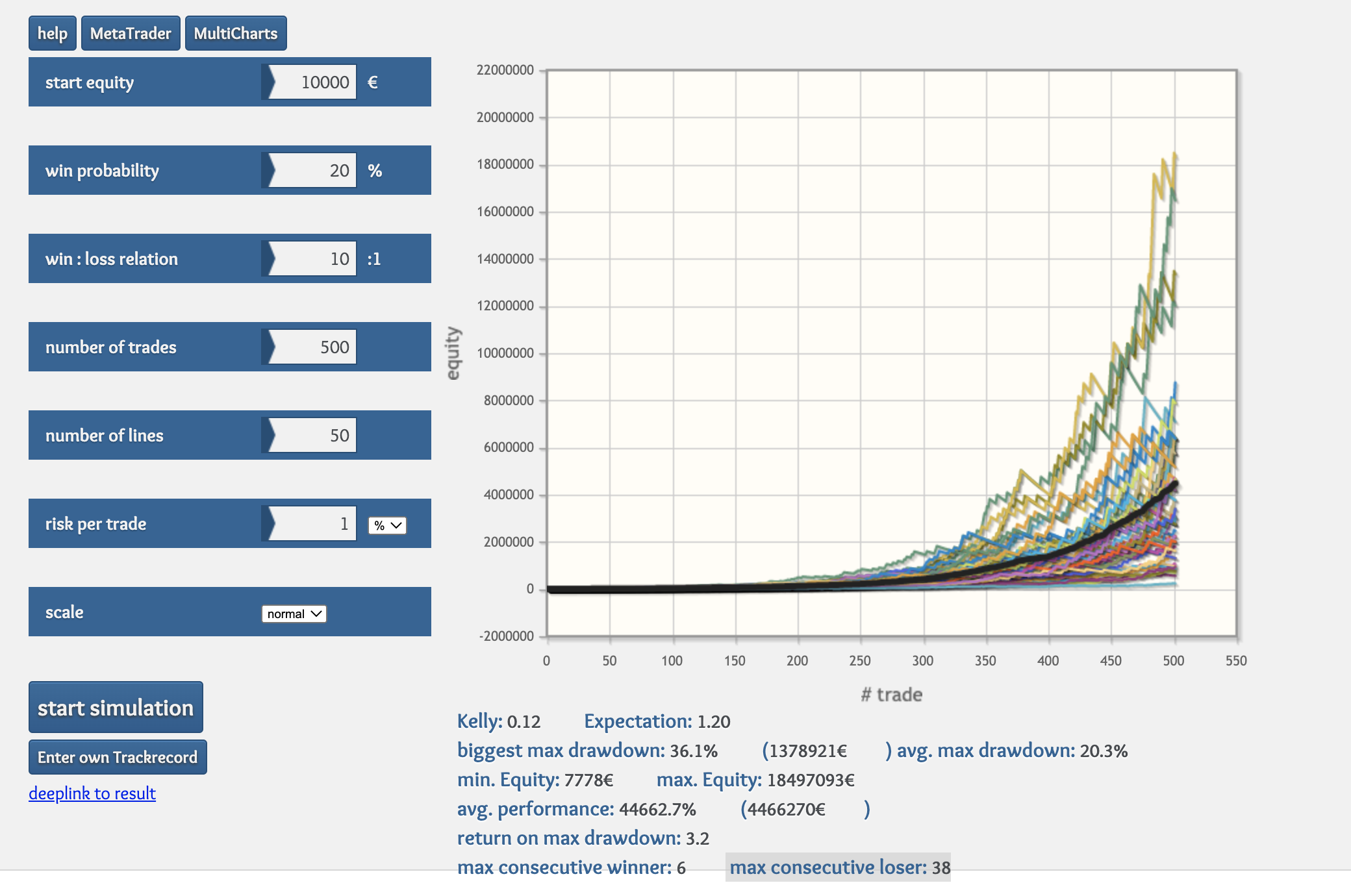

One of the arguments that I have seen online is that these high return trades have a very low win rate, around 20-30% but since the R:R is so huge, it is still a profitable strategy.

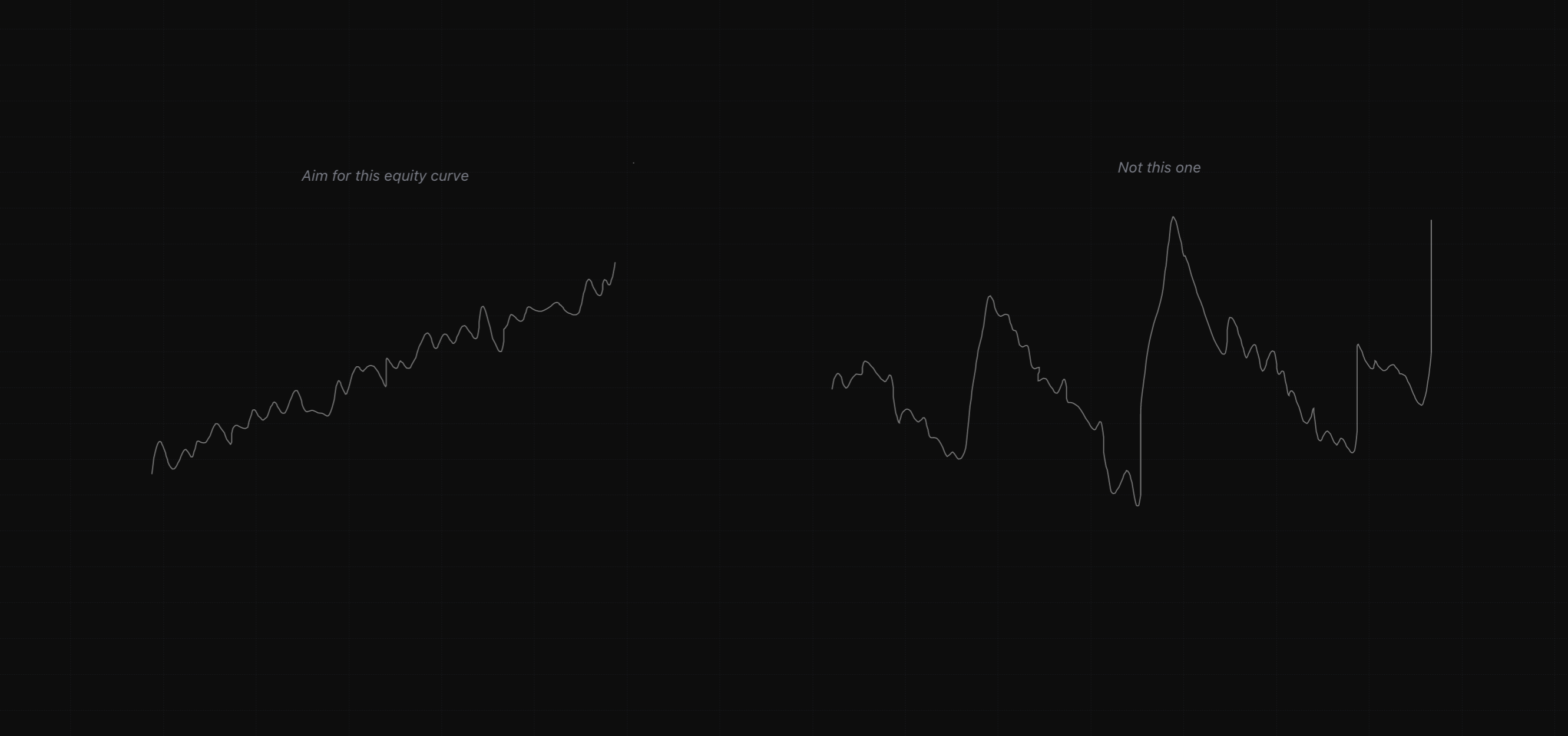

Same 10:1 R: R strategy with only a 20% win rate is indeed profitable in the long run, but if you take a look at the bottom, you will see that one of the equity curves had 38 losses in a row.

Think for a minute you would be able to sit in front of the computer and eat 38 losses in a row without getting tilted and violating some rules that would cause even bigger damage.

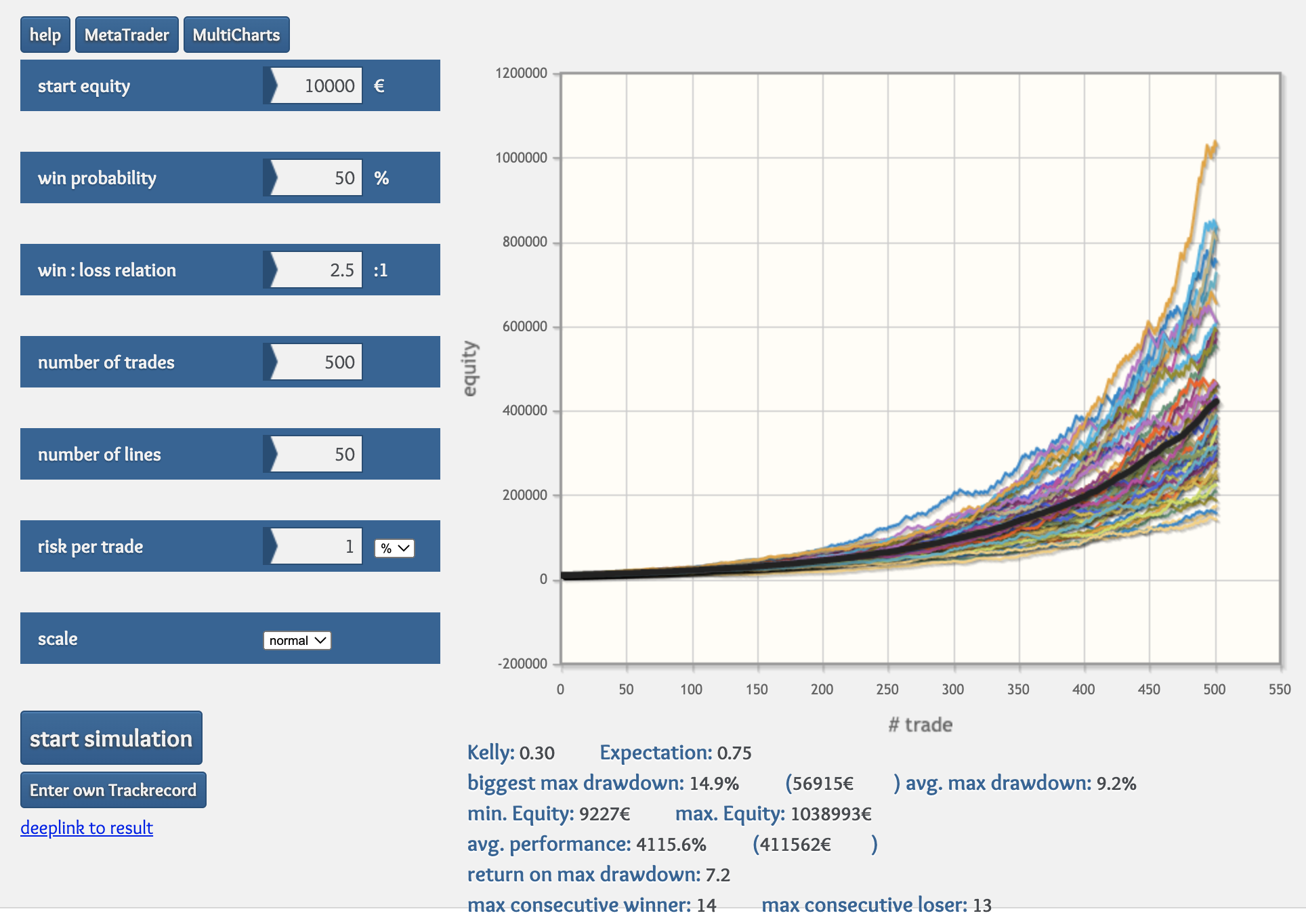

If we run the simulation for one last time looking at a strategy with a 50% win rate and a 2.5 Risk to reward ratio which is much more realistic, you can see that you still have a chance to experience 13 losses in a row.

Even that can be extremely hard to stomach, but if you build a strong track record and have conviction in your system, it will be much easier to survive rather than sitting in prolonged losses hoping to just hit one jackpot that will return 10 times your risk.

But okay, at the end of the day, it is your choice if you want to focus on slowly but steadily building your equity curve or try to hit a home run with every single trade.

If you trade lower timeframes such as a 1-minute chart or tick charts, you will use quite a huge position size with a very tight stop-loss.

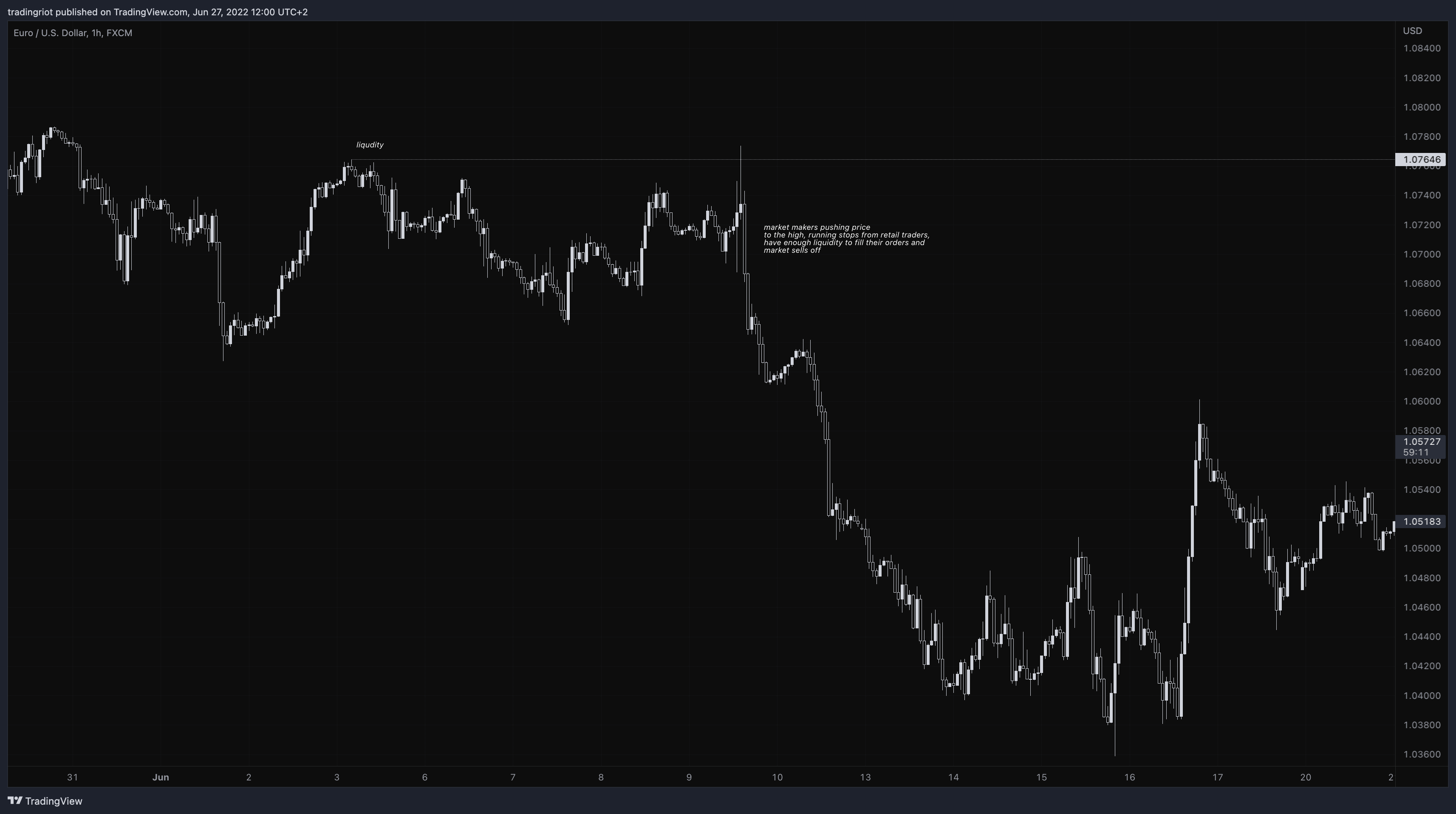

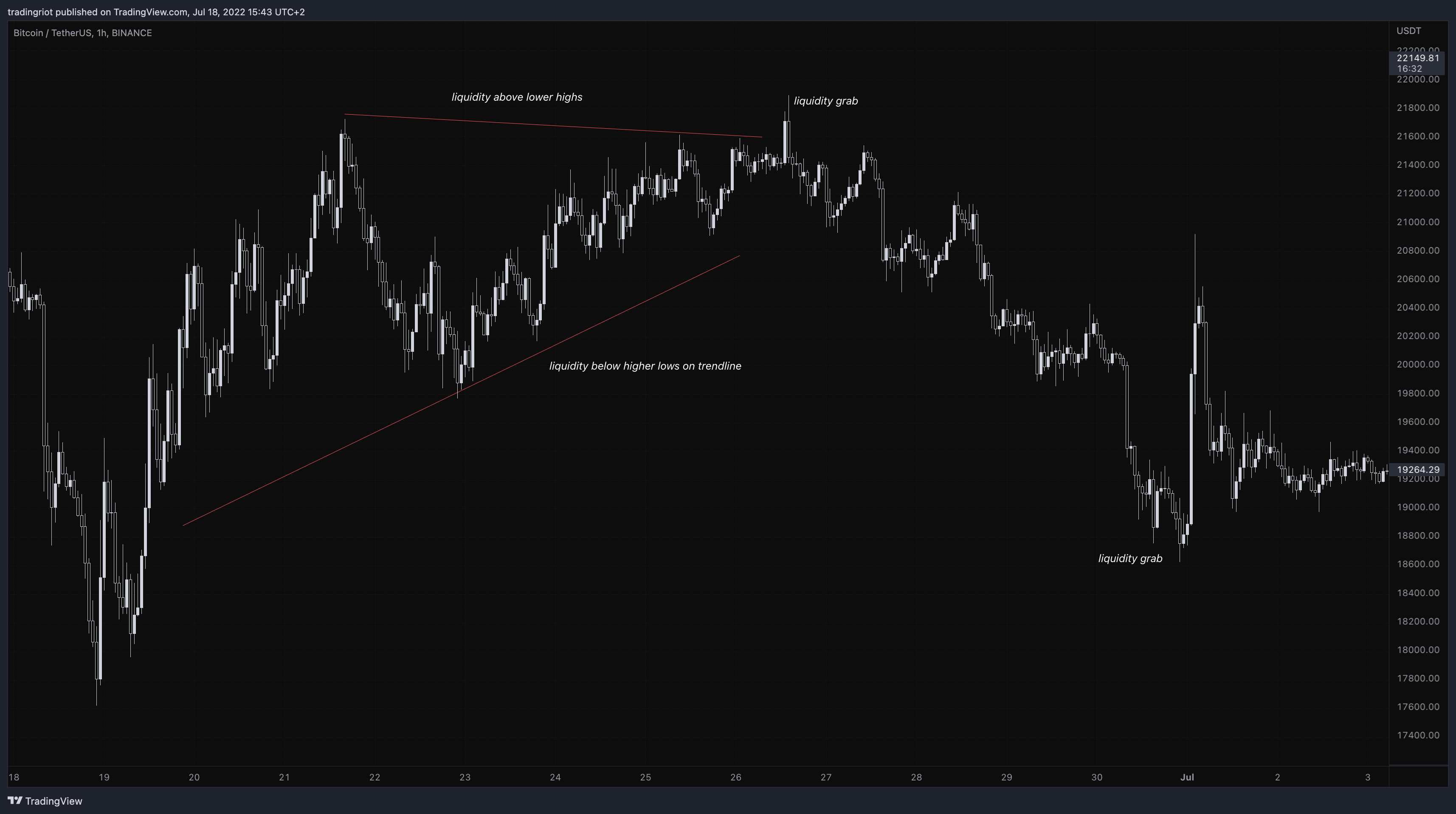

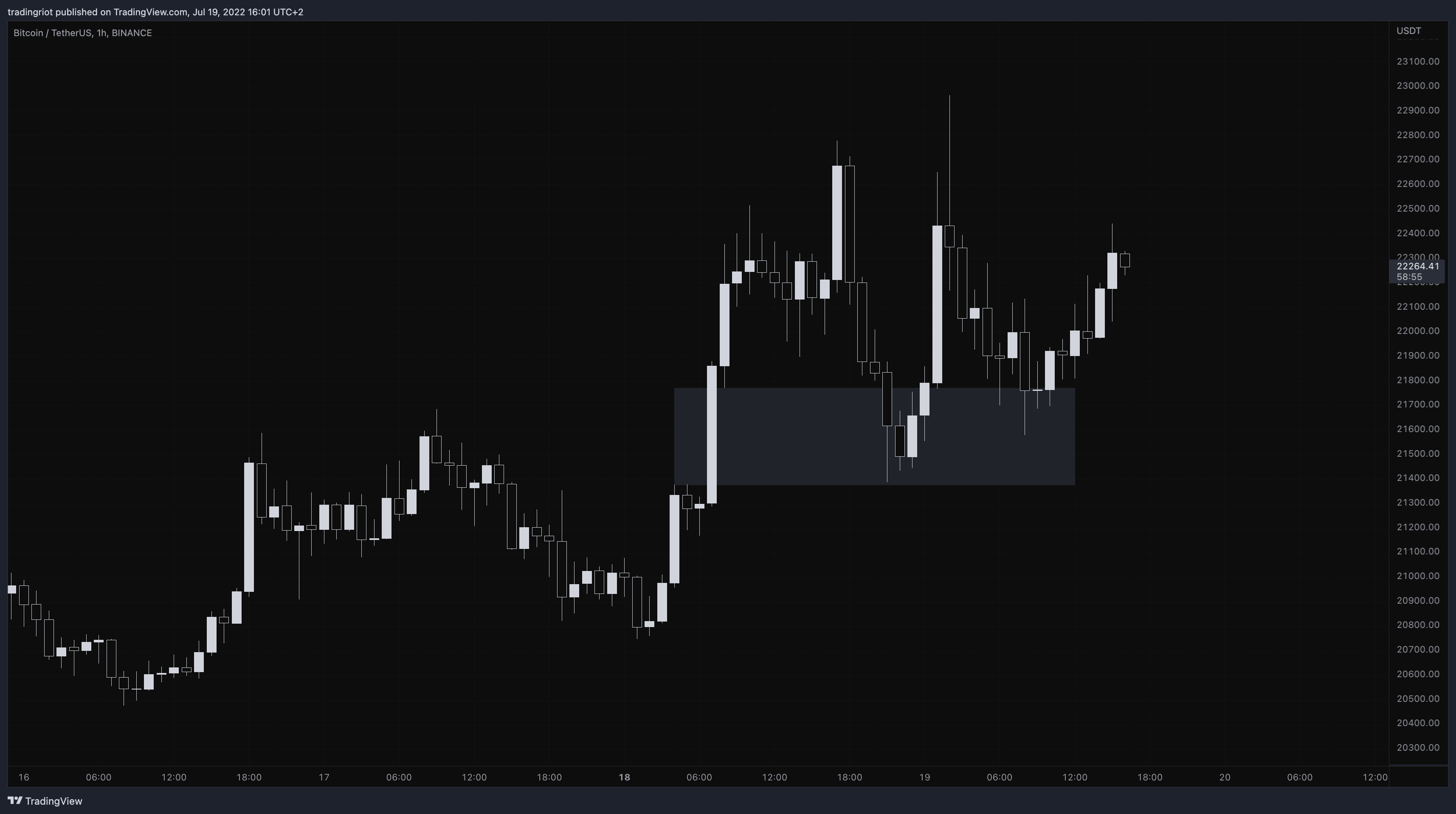

This is a fairly common setup you will see SMC traders take; the market went above resistance to “grab liquidity” and broke structure to the downside after that.

The trade idea is to short the last 1-minute up a candle before the sell-off with a target of lows below.

Trade did not work out in this case, which is completely fine, not all trades will be winners, but we need to look more in-depth at the risk management of this setup to understand the issue.

I know most of you trade with smaller account sizes, but of course, everyone wants to “make it” one day and trade with a lot of money; because of that, for this case, let’s assume you are trading with a $100,000 account and you risk 1% on this trade.

Because your stop-loss is only $27 or 0.13% from your entry, you need short quite a few BTC to make this $27 move worth $1000; to be specific, you need approx $750,000 or 37BTC.

To demonstrate this with a little bit of match, you short 37BTC at $20,287, which equals $750,619.

If BTC goes against you to a price of $20,314, those same 37 BTC are now worth $751,618, meaning you owe the exchange $1,000 because you borrowed to short the Bitcoin.

Of course, all this process is automated, and if you have a stop order at $20,314, the exchange will automatically close your position, and you will lose this $1,000, and you can move on to the next trade, or do you?

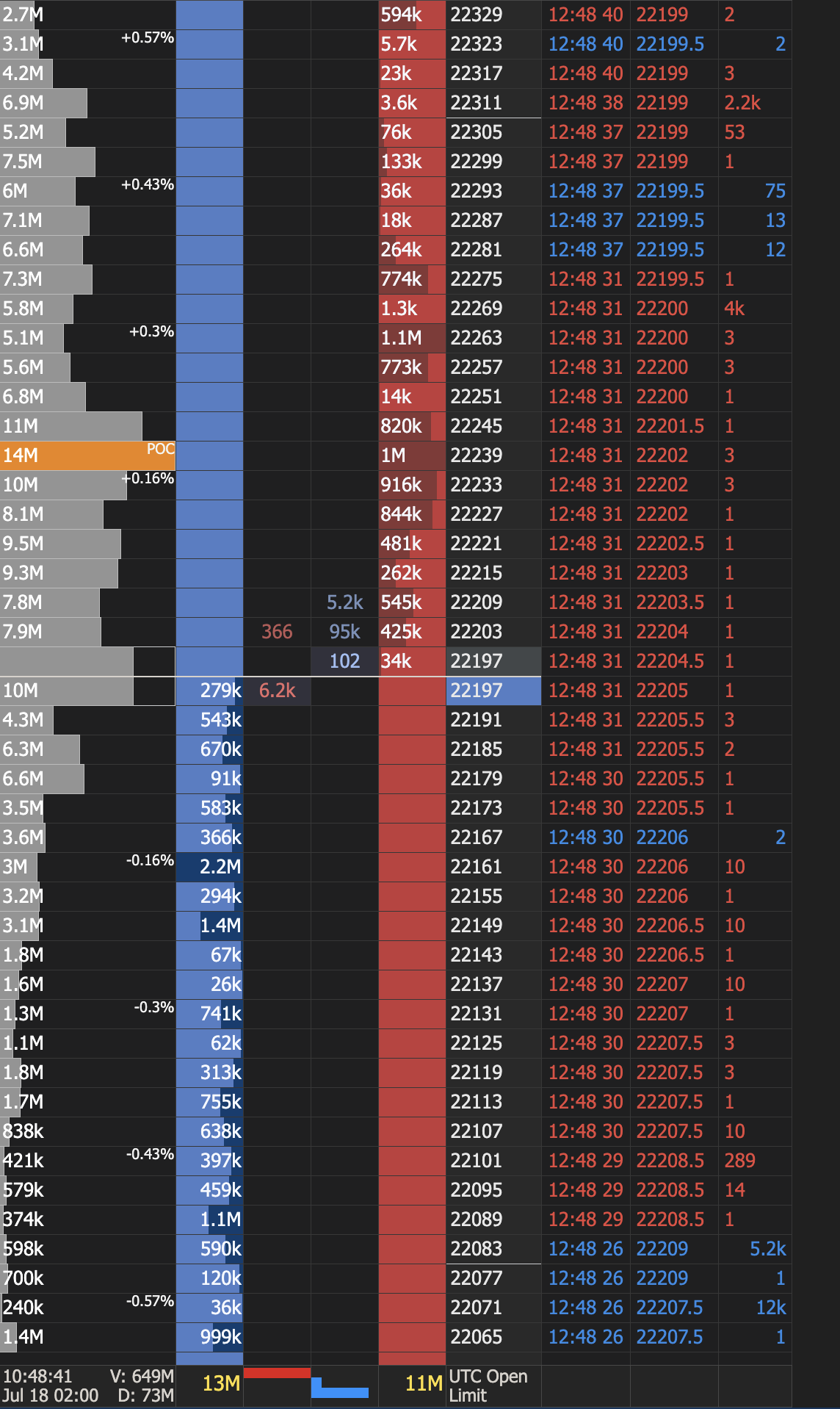

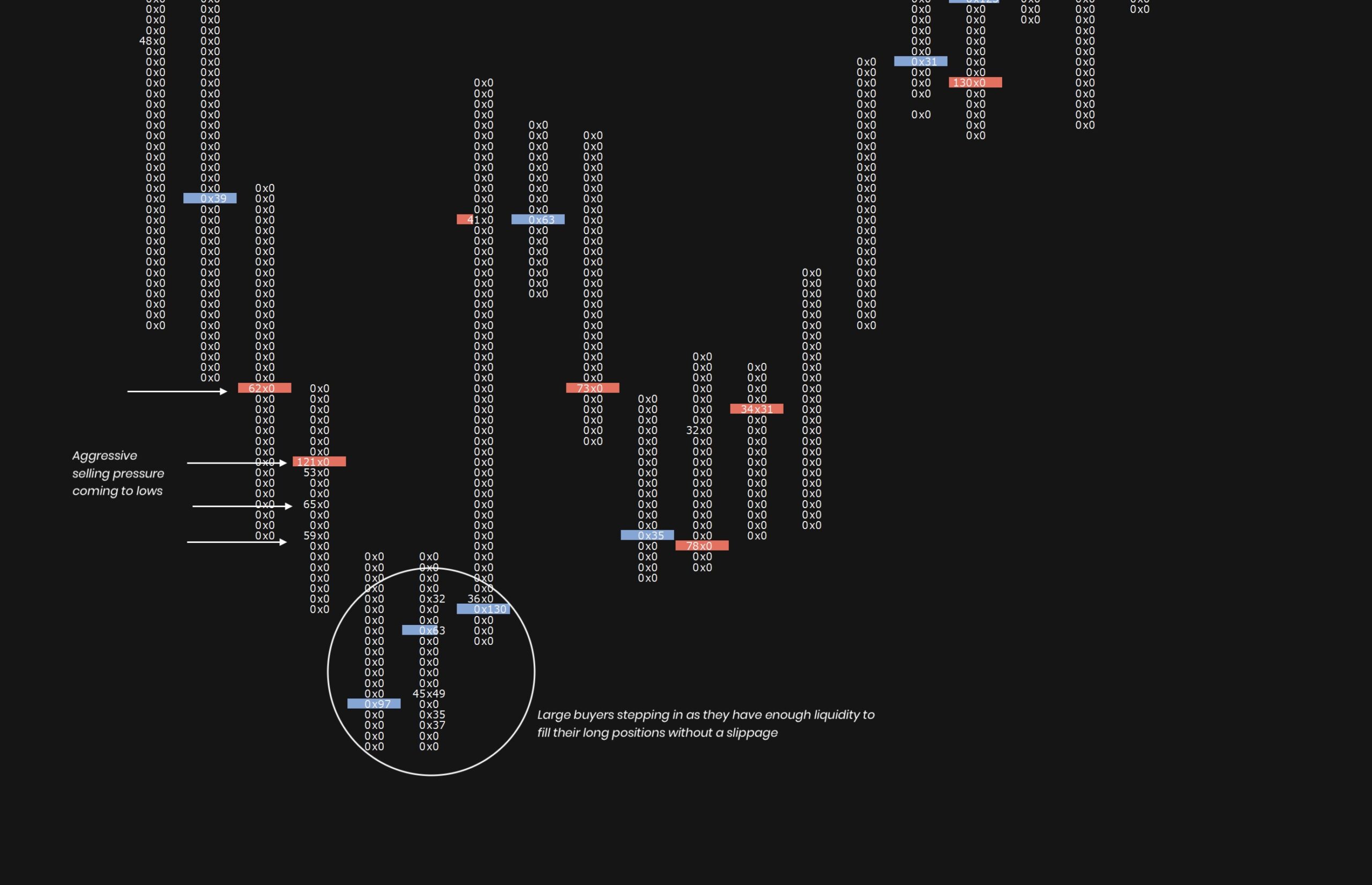

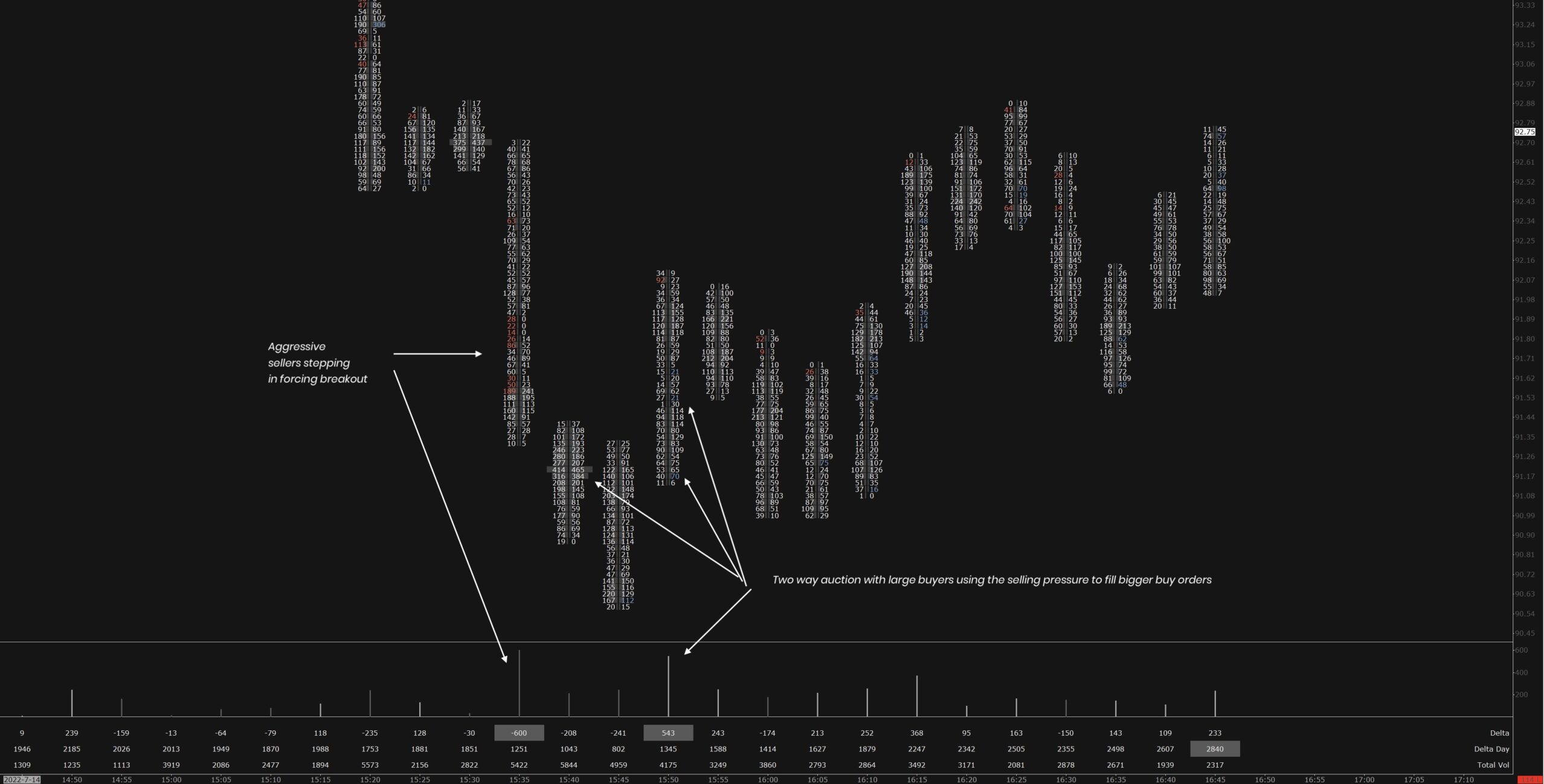

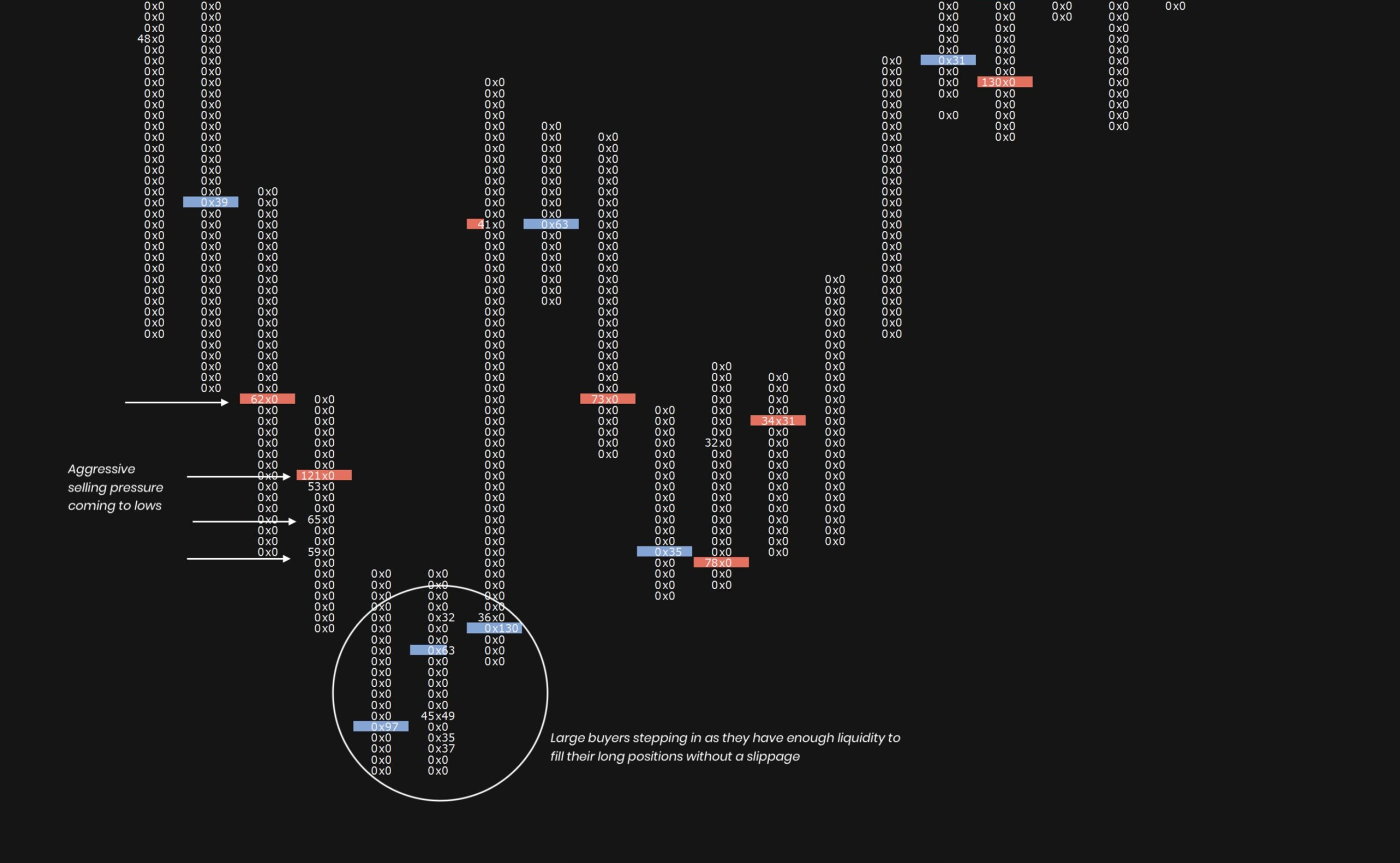

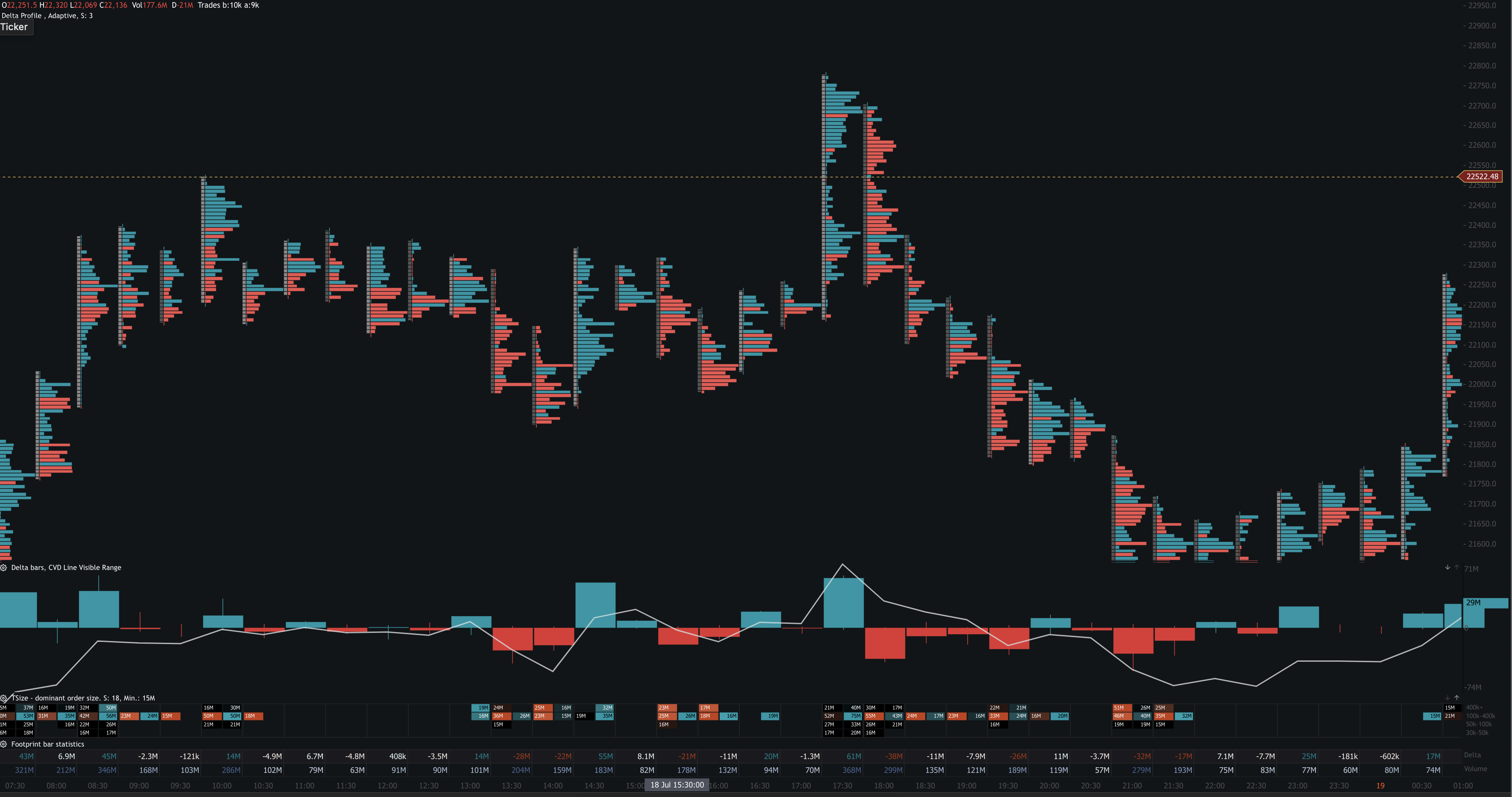

As you can see, this is a footprint chart to give you an extremely simplified breakdown of the numbers on the left show sells and the numbers on the right show buys.

More about footprint can be found in this article.

One of the things you have probably heard in trading is that for every seller, there has to be a buyer and vice versa.

Well, if you sold 750k worth of BTC and you want to get out of the position, you need to find out someone that will buy it from you.

On the chart above, the red line represents the stop loss you put at the exchange, but the blue line above it shows where you would realistically get out as the market has to fill that 37 BTC first.

This is commonly known as slippage, and in this case, you would get slipped at approximately $10.

This is quite a lot if your original stop loss was less than $30, overall, this would result in an additional 0.3% loss ($300) without commissions.

As you can see from this example, if you trade on extremely low timeframes, your 1% risk is rarely just 1%, especially when you trade with a bigger account.

And this example was used on a normal trading day; things can get way worse during high-impact news when market makers pull liquidity before the event.

I covered this in the video below.

Trading on a 1-minute timeframe is not unrealistic, it is more than fine in most situations if you trade liquid markets, but you still need to be aware of available liquidity, spreads and commissions.

It is unrealistic to aim for 10R trades with every setup you take and act like it is normal trading.

Even if you could find a strategy that takes 10R trades with a 20% win rate, sooner or later, you would hit a prolonged losing streak which you wouldn’t be able to stomach, especially if you would be trading with more money.

Trading by itself is stressful and requires a lot of dedication; there is no reason to make things harder and try to aim for the huge home run with each trade if you know they are low probability setups.

Money in trading is made over the long run, not with one lucky trade.

Market Making

The idea of the whole strategy heavily relies on “manipulation” caused by market-makers.

The overall edge exists because market makers are this evil entity that sits around the whole day moving the market and running retail stop-losses.

In reality, this is not the job of market makers.

Market makers are making a market, not in the way of evil manipulation but by providing liquidity.

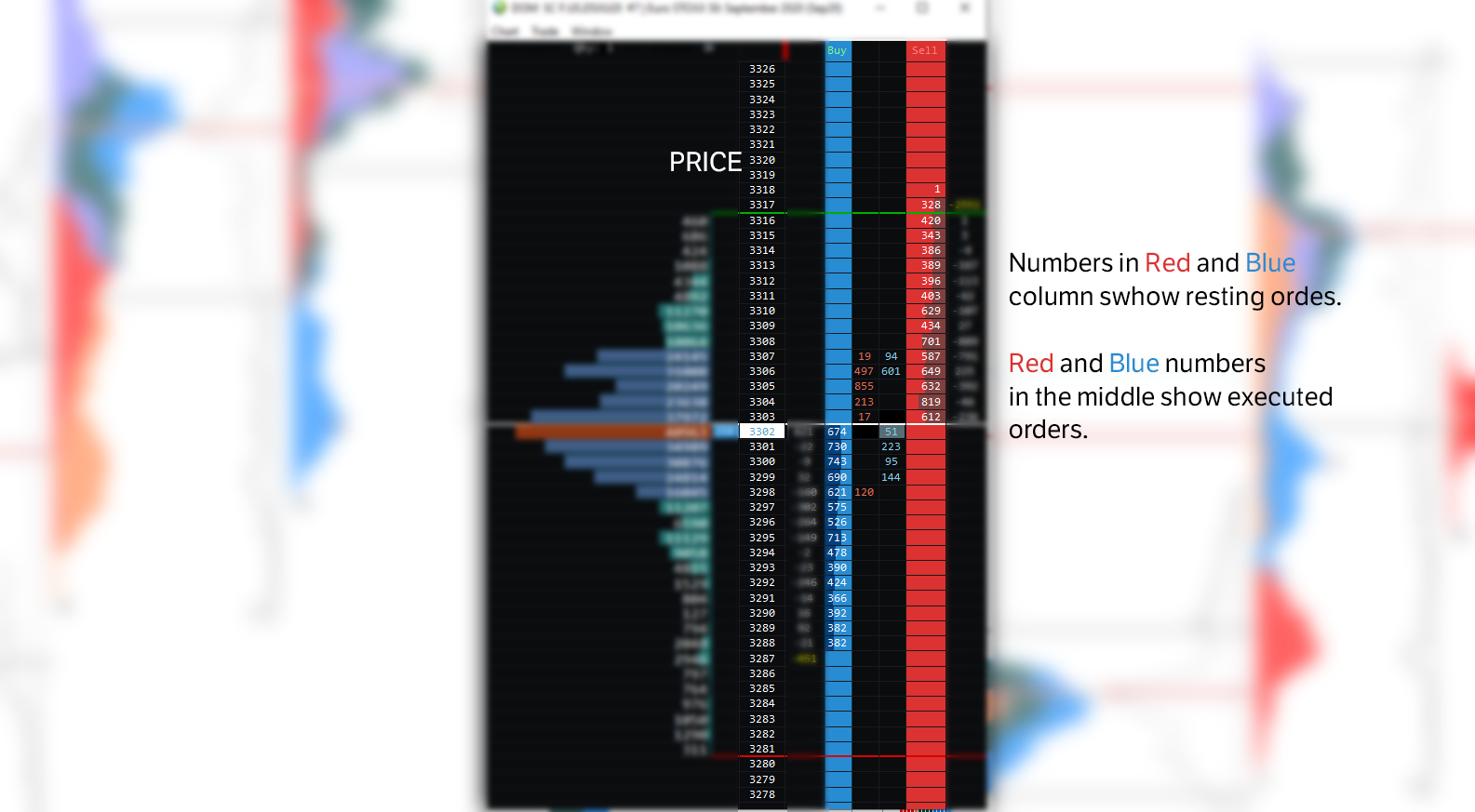

If you look at the depth more market of any ticker, you will see the size quoted on the bid and the offer.

Because the market depths for popular markets such as Bitcoin, E-mini S&P500, Nasdaq, Gold, Crude or Currencies are well populated often thanks to market makers, you will have in most cases no issue to get in and out of the trades very quickly.

The chart above shows the market depth of Euro Stoxx 50, a popular market traded on the Eurex exchange.

You can see that currently, at 3516, there are 464 contracts to buy, and at 3517, there are 455 contracts to sell.

You have two choices if you want to get into the market with a long position.

You can either market buy, this would result in crossing the spread, and you would be in a trade at one tick loss immediately, getting you in at 3517 while the market trades at 3516.

Or you could use a limit order placed at 3516, but your order, let’s say in this case 1 lot, would be placed all the way back to the queue; therefore number would show 467 on the bid, and you would be hoping to get filled.

If you are trading only a 1 lot this one tick spread comes at 10 Euros for this market; this is something a lot of retail traders often overlook and just use market orders as they want to be in positions immediately; this is where the market makers come in.

Market making is what is known as a delta-neutral strategy, in other words, market makers do not care about the direction of the market but are only interested to provide liquidity on bids and offers and making money via collecting the spread.

Because if I would use the market order at 3516 and get filled at 3517, there is someone on the opposite side who just got into the short which got immediately in 1 tick profit.

The picture above shows a very simplified look at market making.

In this case market maker sells one lot to the buyer at $11, collecting one tick spread, but now he/she holds the inventory of 1 lot short.

As I mentioned, market making is a delta-neutral strategy. Therefore, market makers don’t want to hold a position in the underlying asset so now they have to buy 1 lot at $9 to get rid of their short position and once again collect this profit from the spread.

Of course, in the real world, markets can move very quite quickly in a short period of time, so market markers might end up accumulating more long/short inventory than they would really want and they need to manage it accordingly.

Market making is nowadays often done algorithmically, and there are a lot of firms solely focusing on market making.

Of course, there is manipulation in the financial markets.

Brokers in Forex widen spreads, and crypto is heavily running on “insider information” same as stocks and so on.

source: https://en.wikipedia.org/wiki/Forex_scandal

There are also many cases of manipulation in Forex where dealers were front running client orders, but all of this is a different type of manipulation compared to what ICT/SMC traders believe someone constantly running stops on a day-to-day basis.

Liquidity and Orderflow

Orderflow

Regarding ICT and SMC, word liquidity and orderflow get thrown around quite a bit.

First and foremost, the strategy is purely based on price action.

SMC traders do not use any level 2 data or other orderflow tools besides the pure price action; when you see them talk about the “orderflow” they mean just the flow of the market or general trend direction.

This is not what orderflow is, it might be in an ICT/SMC trader dictionary, but overall the “real” orderflow comes back to the DOM I showed you before.

Orderflow studies the relationship between limit orders (Liquidity) and market orders.

It is the rawest form of the price you can observe in the market.

The purpose of this article is not to explain the unique relationship between the limit orders and market orders; I did that in an article about Orderflow trading.

For the sake of this article, you should understand that orderflow is the most zoomed-in view of the market, and there are several tools such as DOM, Footprint, Time and Sales, and so on help traders extract important information from the flow of the orders.

Liquidity

The concept of liquidity plays a key role in ICT/SMC trading.

The areas of liquidity are found below and above horizontal/diagonal lines.

They are areas where retail traders place their stops and are often taken by smart money.

Once again, why these moves happen is way more boring than giving credits to some hidden force.

Everything comes down to the orderflow, and how market participants interact at certain levels.

Of course, the simpler the better; if you trade by using Elliot Waves, Gann Boxes or some other highly subjective strategy, it will be hard to find levels where there is a lot of interaction.

But for those who use simple horizontal or diagonal lines, or even something like popular moving averages (50,100,200), you will see that there is interaction at these levels.

All financial markets work in a two-way auction, this means that for every buyer there has to be a seller and vice versa.

If the market reaches something like a horizontal level of S/R, usually triggers two types of events.

Of course, there are stops getting triggered, but in a lot of cases, there are also traders and algorithms who are trying to force continuation past the level.

If you take a look at the example above on EUR/USD chart, once the price broke below the support line, it triggered stop orders from long positions; these stop orders are sell orders.

Other than that there are also new sell orders coming to the market from those who try to trade trend continuation.

Since for every buyer, there has to be a seller (and vice versa), this aggressive selling pressure makes a perfect environment for large players to enter the long positions.

As you can see above, this is a footprint chart of the EUR/USD (6E futures contract) where you can very clearly see this dynamic on a footprint chart.

Once the low is broken, there is increased participation from selling activity (both stops and new orders coming in), but once the market reaches the low, large buyers suddenly step in and fill their long.

Why does this happen exactly there?

It goes back to the example from Euro Stoxx on trading DOM.

If you use a market order, you are crossing a spread, and you are instantly in 1 tick drawdown.

Trading once contract on these Euro futures would put you at a $6.25 loss, which is one tick of this product.

This is something you can stomach; it is not a big deal if you trade only 1-2 contracts, but how about if you want to buy 100, 500 or 1000?

As you can see there on footprint, there is a buyer who filled 130 contracts at one price; if he would just trade at the unfavourable spot where liquidity is thin, they might end up in several tick drawdowns just from the spread; this can easily equal over $1,000.

But if they are smart and do business in areas with a lot of participation, they can fill their orders without any slippage.

Once sellers see that their new shorts are getting absorbed by larger buyers and the price is simply not going lower, they start covering their positions which will once again turn their sells into buys, and prices will push higher.

From an orderflow perspective, every situation is different, sometimes there is a large limit order resting below/above the level; this is a signal of new participants wanting to step in, not stop losses as you cannot see stop orders on DOM; this is a common misconception among newer traders.

These heatmaps are often the tool of choice of a lot of newer traders, and they think they are all an end-all tool to use.

I don’t think that personally, as there are a lot of cases where buyers or sellers put spoof orders in the DOM, which are orders that they don’t want to fill but just create confusion.

Once the price starts to come to large resting order, a lot of smaller traders start to buy ahead of it only to see it get pulled last second and the market smashing through as the spoofer was filling the opposite order the whole time.

I covered this more in-depth in the Market Microstructure article, which is a good resource for understanding more of these market dynamics.

The bottom line is that thinking that markets only probe horizontal/vertical levels in results of stop-run from smart money to retail traders is more than silly.

There is much more going on at these levels, and actually, the stops triggered very often play the smallest part.

If you ever decide to invest more time into looking at orderflow, you will start seeing it for yourself; for that, you can join the Tradingriot Bootcamp, where all the techniques are explained with the detailed process of trade execution.

AMD/Power of three

One of the popular patterns I have noticed is often shared online is called the Power of three or AMD (accumulation, manipulation, distribution).

Originally this has been presented as a “fakeout” on major forex pairs during the London open to the extremes of the Asian range but it can be applied to different timeframes.

This is a great pattern and can be observed often as price tends to push to the less liquid side of the market to see how participation would be, but once again I wouldn’t look into evil manipulation behind it.

As with previous examples, markets trade under the prior high/low and increase participation as both stops are triggered and new players step in.

One of the characteristics of the pattern is the quick reaction from the low that has characteristics of V-reversal, in other words, there is no time acceptance at new prices.

This can be your signal of a “fakeout” and possible reversal.

Once again something that we can find a logical explanation by just looking at the orderflow and participation at the lows.

Order blocks / Supply and Demand Blocks

Another extremely popular concepts are order blocks, these magical rectangles that are used in trend continuation and once price hits them it just bounces off from them.

Over the years, these things get a lot of different names and explanations.

The main idea in ICT/SMC terminology is that these areas are used by smart money to fill their orders.

Well, to be fair this is not so far from the truth, but once again, there is all this smart money/retail trader lingo to make things sound way more mysterious than they should be.

As already mentioned large traders cannot execute their positions left and right; they need to do it in beneficial areas with enough liquidity to avoid additional costs.

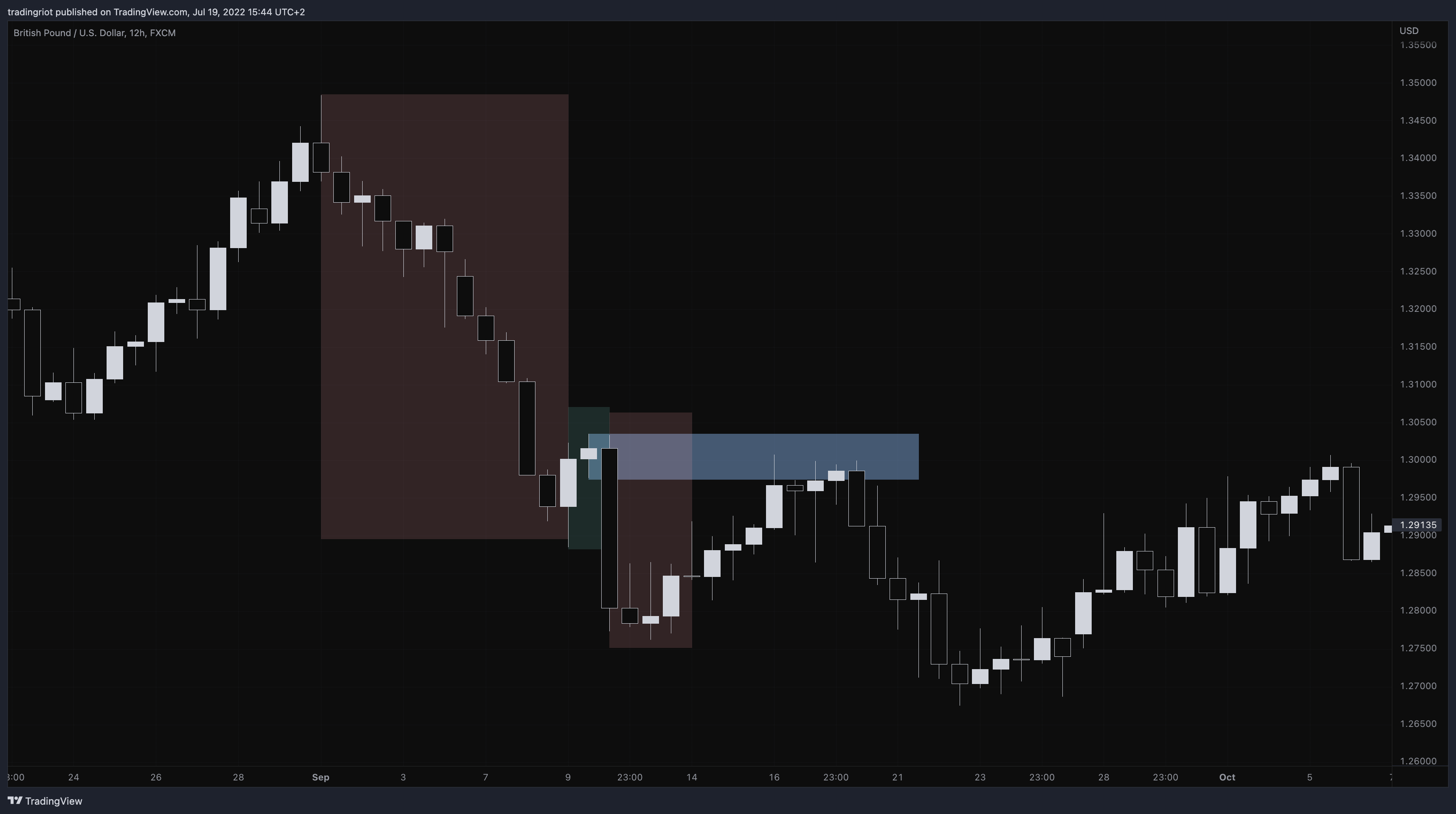

If you take a look at the example above, the image you want to sell 1000 lots on this GBPUSD.

Would you do it in a red box where the price is going down and there are not many buyers willing to buy or would you do it in the green box where the price is pulling up and you have sufficient counterparty to fill your orders?

Of course, the green box makes much more sense.

We can also validate this idea by using something like a Volume profile, which clearly shows us that in the area of so-called “order block”, the most volume was transacted from the whole leg down.

The reaction from the area on retest happens due to something called order-splitting.

The large participants often cannot fill all their orders at once, and they will use the same areas of previously high executed volumes to place their orders again.

Another less significant reason is called herding, which is simply traders buying/selling into the moves they see.

This market behaviour has been studied in depth to the point that you can find plenty of research papers about it online; one of the easily digestible ones is called “Why is orderflow so persistent” and you can read it here.

Here you can read a short quote from the paper that explains the topic more in-depth:

“Equity order flow is persistent in the sense that buy orders tend to be followed by buy orders and sell orders tend to be followed by sell orders. For equity order flow this persistence is extremely long-ranged, with positive correlations spanning thousands of orders, over time intervals of up to several days. Such persistence in supply and demand is economically important because it influences the market impact as a function of both time and size and because it indicates that the market is in a sense out of equilibrium. Persistence can be caused by two types of behavior: (1) Order splitting, in which a single investor repeatedly places an order of the same sign, or (2) herding, in which different investors place orders of the same sign.”

Fair value gaps

Fair value gaps are often connected to order blocks.

These thin points in price show us clearly where buyers or sellers stepped in.

These liquidity gaps happen when one side usually steps in a very aggressive manner and price spikes quickly in one direction.

If we are going to take a look at volume distribution in each 60-minute bar from the chart above, we will be able to see that there was a “gap” left in the distribution right when buyers stepped in.

These gaps often tend to get filled and we can use them to find potential “order blocks” as they are areas where one side showed aggression and are likely to defend the level on revisit.

Once again, these “fair value gaps” are nothing new; in fact, they were first presented by Paracurve in 2011, as different types of liquidity gaps.

Market structure

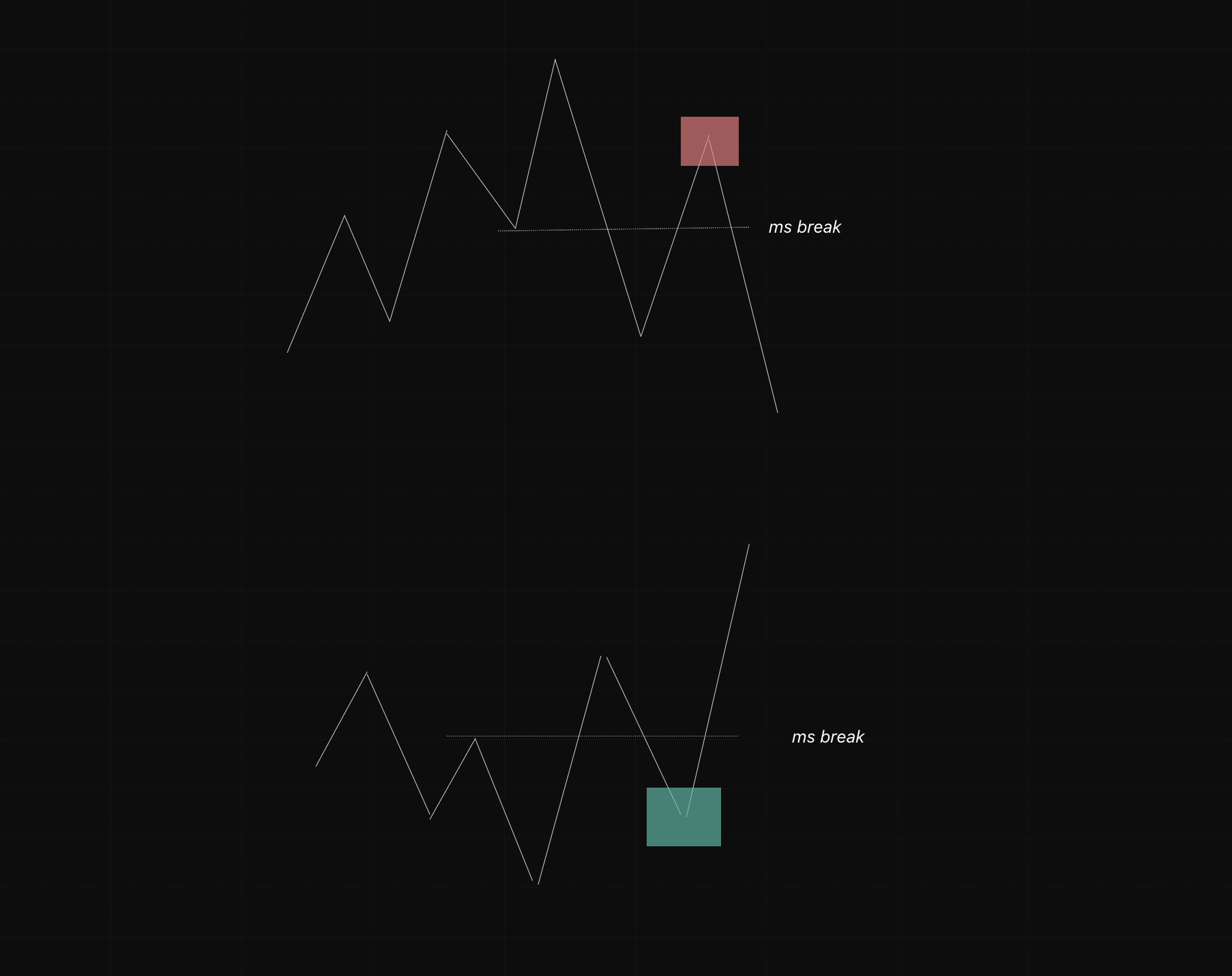

There is a high emphasis put on the market structure when it comes to ICT trading, especially when the structure is broken.

What you see above is basically the entry model of every ICT/SMC Trader.

The market structure is an essential factor for any price action trader, but I feel like a lot of people tend to misunderstand it.

First of all, tracking every swing point and watching if it gets broken is useless, if you take a look at any actual chart and drop the clean infographics, you will understand that markets are much messier compared to cherry-picked examples.

When you are looking at the market structure, you should not strictly look if higher highs and higher lows are respected in downtrends but see market structure more as an indicator of strength and weakness.

Getting too stuck on the market structure can make you lose sight of the bigger picture, you should always be asking in what areas there is a high likelihood of bigger players to step in and where is enough liquidity in the market to cause a bigger move.

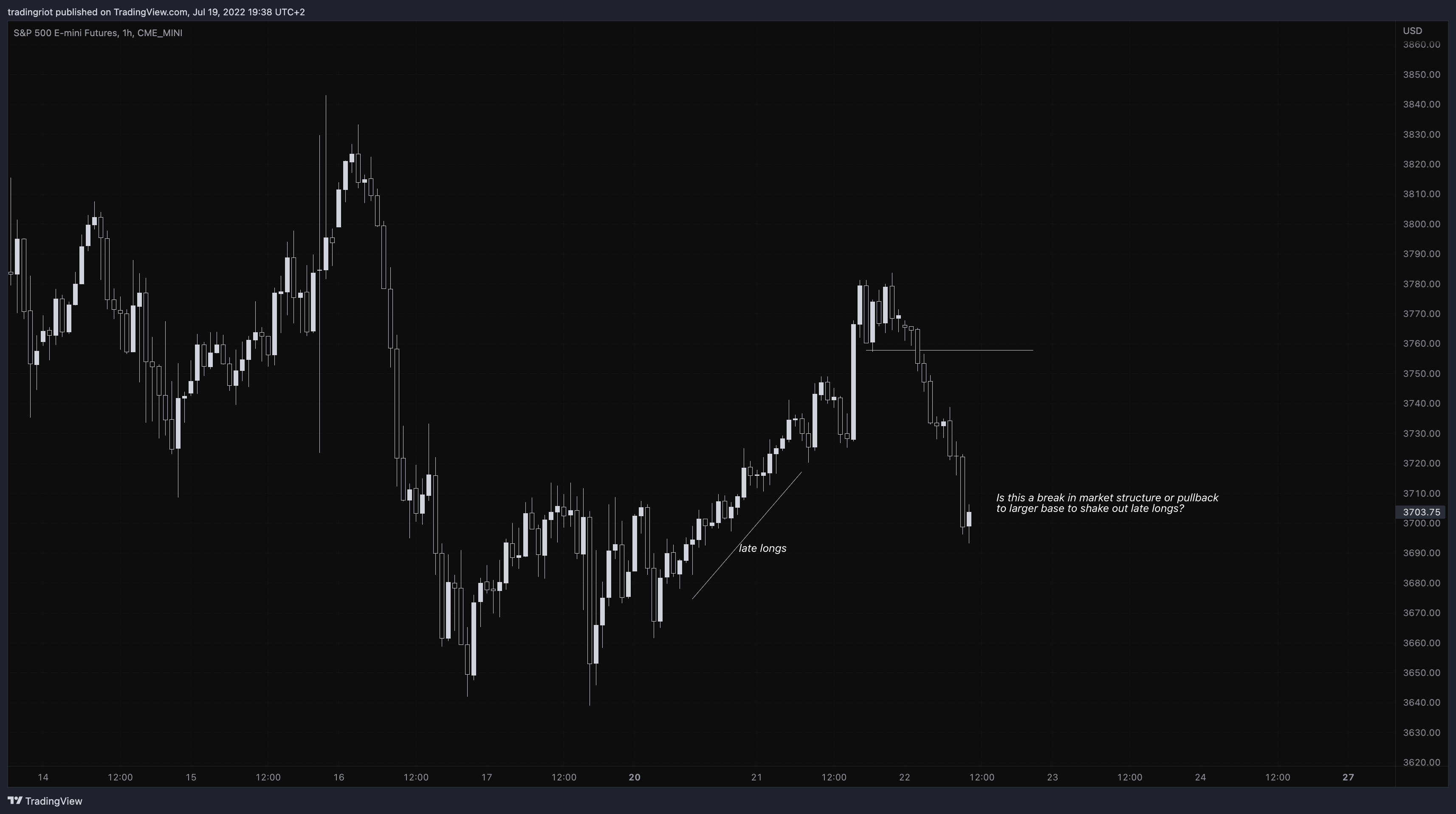

As you can see in this case market pulled back into the area of high executed volume where there were a lot of resting orders and also took out the FOMO longs as the stops were most likely resting below the trendline.

It doesn’t matter if the market structure was broken to the downside in the process.

Timeframes

The timeframes are another topic in this trading strategy which can keep quite a few people confused.

When it comes to the “liquidity sweeps” ICT traders often look for candles that trade above/below previous swings but the candle has to close with a wick, but is that really important?

This is the EUR/USD chart that I already used, now we are looking at a 90-minute timeframe.

As you can notice the 90-minute candle closed very strong throughout the level, not the most bullish sign.

But if we add another 30-minutes and look at the 120-minute chart, it looks way better with a candle with a long wick below the support.

It doesn’t matter if you look at the 30-minute, 60-minute, 72-minute or 108-minute chart; what matters is the participation at the levels.

Relying simply on a candle close based on one pre-determined timeframe can be very dangerous, what is more important is participation in the candle and if it finds acceptance or not.

As you can see on this 30-minute Bitcoin chart the breakout based on this timeframe looks excellent, strong close throughout the level ready for continuation.

No signs of this could be a “sweep” of the highs.

But if we have a look at the footprint chart that shows buying and selling in each bar, we can see that there was a high pick up on buying after we broke above that prior high; it doesn’t really matter that the candle on pre-determined timeframe just closed, what is important if there will be enough buyers to force the continuation or if the move just got absorbed by passive sellers and is ready to roll over.

As you can see in this case buyers were not able to hold it and the market sold off 1000 points lower.

Conclusion

Trading is a complicated business, and besides having a solid strategy, you need to have a robust risk management model in place; otherwise, no matter what system you trade you won’t be able to make it in the long run.

The strategy by ICT is solid, it provides some valid points and market behaviours that tend to repeat; therefore, you will be able to make profitable trades using them.

I don’t know if ICT is a good trader, but I know he is a great marketer as he renamed and overcomplicated everything to this “hidden secret” coat that is extremely appealing to new traders that will quickly feel like they are also part of this secret club.

This way, he built a huge cult following over the years of people that would spend countless hours online arguing about market makers running everyone stops left and right.

Whatever you believe or not, it’s essentially up to you. I hope I could shed some light and provide a more logical explanation of these concepts, but as long as you can be profitable and manage your risk, you are on a good path.